Launched in May 2020, our air traffic forecast was originally designed as a response to pandemic uncertainties. It has since evolved to cover other key factors: macroeconomic growth, levels of disposable income, and carbon mitigation costs. Now extended to the end of the decade, the forecast is updated regularly using the latest information.

Here is the outlook as of the end of the first quarter of 2025:

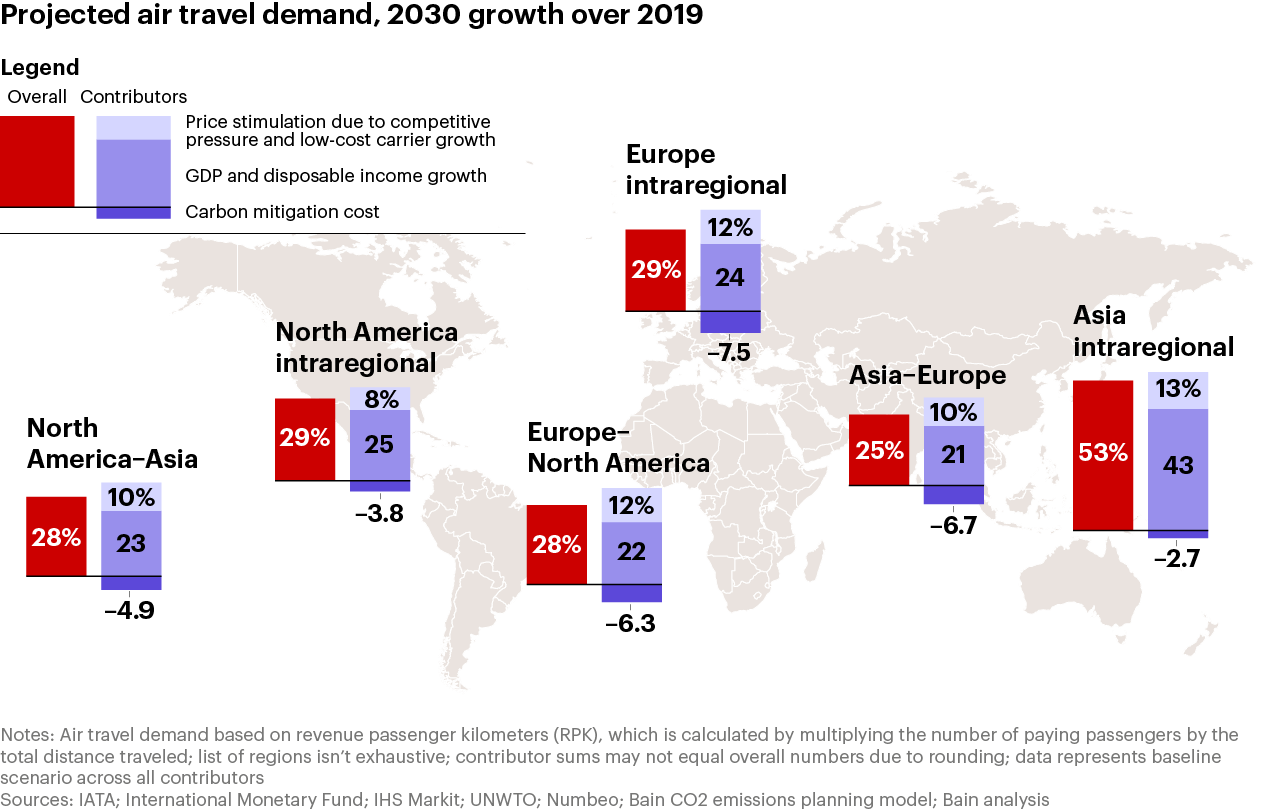

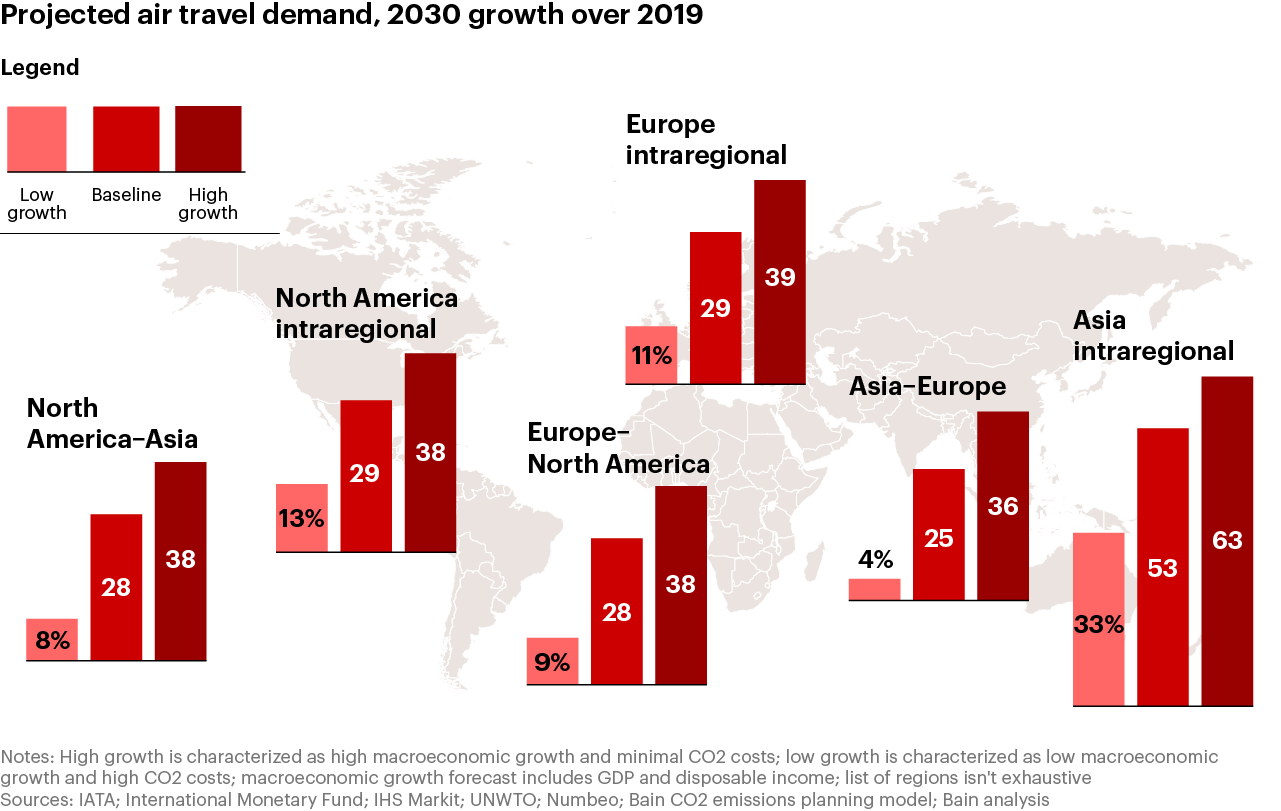

- Annual air travel demand returned to prepandemic levels last year, surpassing the 2019 total as measured by revenue passenger kilometers (RPK)—the number of paying passengers multiplied by the total distance traveled. Last year’s demand was in line with expectations, reaching 102.6% of 2019 value (see Figure 1 above). By 2030, we anticipate global RPK will reach 11.3 trillion in our base scenario, which would be 136% of 2019 volume. Meanwhile, several factors have contributed to changes in the forecasts for specific regions and countries (see Figures 2 and 3).

- Weaker-than-expected demand in the US and Mexican domestic markets lowered the 2030 outlook for North American intraregional travel demand by 2 percentage points vs. the previous quarter. This is equivalent to a $2.3 billion revenue decrease at current yields.

- We continue to anticipate significant intraregional demand growth in Asia—a 53% increase from 2019 to 2030.

- Looking at specific countries, by 2030 the US is positioned to surpass the UK as the world’s largest market for outbound international travel, thanks to a substantial increase of 21 million travelers from 2024 to 2030.

- With an increase of more than 26 million travelers, China is on track to reclaim its position as the third-largest outbound travel market by 2030, recovering from a dip to seventh place in 2024. India’s robust growth trajectory puts it on pace to rise to ninth-largest outbound travel market, with particular gains in long-haul travel.

- Europe will continue to claim several of the top short-haul outbound markets in 2030: the UK (69 million short-haul outbound travelers forecasted), Germany (47 million), and Spain (40 million).

Projected market and financial information, analyses, and conclusions are based (unless sourced otherwise) on external information and Bain & Company’s judgment. They are intended as a guide only and should not be construed as definitive forecasts or guarantees of future performance or results. No responsibility or liability whatsoever is accepted by any person, including Bain & Company, Inc., or its affiliates and their respective officers, employees, or agents, for any errors or omissions.