Etude

Retail banking has reached a critical juncture where banks should stop hedging their bets with respect to modernization strategies and start making fewer, better sequenced investments.

Many retail banks have selected an "all of the above" approach to strategy, trying to keep their hands in play as a hedge against any competitive or disruptive scenario. They’re building products or platforms in their core businesses and off to the sides, such as niche payments platforms, where consumer adoption could be years away. They have sprinkled their innovation portfolios with equity investments across a wide array of companies and sectors.

Having such a diverse set of activities under way means that banks are not making necessary strategic trade-offs, much like an athlete who wants to win the marathon, but trains for every track-and-field sport. And as cost pressures mount, banks face decisions to slow or stop investing in critical capabilities, which could prevent them from moving to a winning strategic and financial position.

Insurgent financial technology firms, meanwhile, have focused on the most attractive customers: the 10% that generate 120% of profits at most banks. To be sure, these fintechs (PayPal in payments, Funding Circle and SoFi in small-business or consumer credit, Wealthfront in investing, and others) have gained only limited share to date. Alternative marketplace lending, for instance, originates less than 1% of global loan volume. But fintechs demonstrate strong growth rates by providing better customer experiences and improved rates for borrowers and by having lower cost structures.

Moreover, major technology firms, such as Amazon, Apple, Facebook and Google, could take on many of the activities that banks perform, by leveraging their huge networks of users, especially in countries where regulators are more liberal in granting banking licenses. For example, Ant Financial in China combines Alibaba’s online payment business, Alipay, along with deposits and lending, effectively creating a complete online bank.

It’s much easier for a tech company to become like a bank than for a bank to become like a tech company. Retail banks thus risk having their strategies dictated by new entrants and losing their role as leaders in the banking ecosystem (see Figure 1).

Potential future scenarios

Most of the realistic scenarios for the next five to ten years require banks to make stark choices about how, and how much, to transform their current businesses. We have developed four scenarios that could unfold, depending on how key uncertainties play out in different country markets.

Contained disruption. In this relatively mild scenario, significant inroads by insurgent competitors hit only the periphery of payments and net-interest-margin products, such as credit cards, investments and deposits. Banks continue to own the relationship with customers, but they must manage more third-party channels, such as aggregators, in order to generate new business. For a useful analogy, consider that as the pharmaceutical industry has experienced contained disruption, pharma companies have responded by partnering with or buying biotech companies on the forefront of innovation.

A new ecosystem. In this scenario, upheaval comes to select categories in which banks would lose a fraction of their profit pools, such as consumer credit. Partnerships between banks and fintechs become the new norm, and customers decide which entity has the most convenient point of entry. The telecommunications industry illustrates this scenario: Incumbent providers continue to capture the majority of the profit pool as they adapt to an evolving ecosystem while insurgent over-the-top providers of content, such as Netflix, share in household spending on media content.

Disintermediation. Massive change occurs in customer-facing activities across most profit pools, leading to "game over" for banks’ distribution channels. Leading tech firms with high credibility among consumers, such as Apple and Google, assume the role of integrator and take over the main customer relationship. That leaves banks with a back-end role, supplying the tech firms with a flexible, low-cost application program interface (API) and continuing to underwrite loans. The music industry has experienced disintermediation in the shift from physical media to digital downloads and digital streaming.

Full substitution. This most severe scenario envisions that major tech firms own the customer relationship and also take on most or all bank activities in many countries, effectively becoming a bank. The photography sector saw full substitution play out with the shift from physical film to digital images.

The extent and timing of these scenarios will vary by country. Disintermediation and the potential for full substitution have already been demonstrated in China, as evidenced by Ant Financial. Regulators in Europe also are starting to open the field to competition. By contrast, regulators in the US, Canada and Australia emphasize stability and have been more cautious in issuing banking licenses.

Scenarios also hinge on customers’ willingness to do their banking with new entrants, their perceptions of Internet security and the level of smartphone penetration. Finally, the scenarios will depend on the ambition of major tech firms that have been flirting with bank services through initiatives like Apple Pay, Android Pay and Amazon Lending, a program that offers loans to small sellers in 10 countries.

Senior bank executives and board members can consider three broad factors—the regulatory environment, consumer sentiment and big tech firms’ ambition—to develop a sense of likely scenarios in their countries over the next five to ten years. Even in the most conservative scenario—contained disruption—net interest margins and fee incomes probably will continue to be pressured. That implies increased levels of consolidation in certain markets, such as the US, and the need to further reduce costs in order to defend a decent margin.

To counter potential competitors, banks have enduring strengths that include regulatory and compliance expertise, access to cheap funding, large capital and customer bases, and proprietary customer data. On the backs of these strengths, banks can influence their future if they map out strategies that entail making deliberate, hard choices that move beyond incremental digitalization.

Their choices cluster in several areas. Each bank will have to define its overall strategic ambition, or its desired endgame, and then map out where it should play—by country, by product and by customer segment, as well as where to participate along the value chain. Critically, the bank must articulate how it will win in each chosen market: its overall proposition to customers, as well as the capabilities in which to excel. These choices should be robust enough to protect the traditional business and to attack new, attractive profit pools.

Joe Fielding, a partner with Bain's Financial Services practice, discusses how banks can build strength in four areas to evolve their strategic models for the digital age.

Five strategic options to choose from

Banks have five strategic options:

Relationship master. This option focuses on building strong customer relationships, delivering an excellent experience for customers and monetizing relationships by earning greater customer loyalty and by gaining a high share of customers’ financial spending. Banks such as Regions in the US and many local savings banks in Germany are pursuing this approach. The winners will have a customer-centered organization that understands how to complement digital interactions with the human touch.

Back-end utility. Some banks are choosing to focus on core activities (transaction accounts, lending and underwriting) and the traditional balance sheet, while allowing other firms to control the primary relationship with customers. The Bancorp, a US-based white-label provider that partners with fintechs, has taken this route. Winning with this model requires distinctive, sustainable access to wholesale and low-cost deposit funding. Lean, fast underwriting capabilities to ensure rapid fulfillment and a strong risk-reward profile are also essential, as well as having a flexible, open API that connects seamlessly with other firms’ technology platforms.

Digital category killer. This model involves building a specialized digital platform for a particular category. It works when a bank has a well-known, credible franchise with a large customer footprint that can generate a lot of digital traffic as part of a specialized offering. For example, Charles Schwab’s direct bank has been built around its core franchise, from asset management, advisory and brokerage into basic banking and payments. Success here requires a flexible platform to incorporate products from other companies, as Schwab did with its credit card partnership.

This could be done by building a separate online business, using its own brand or under a new brand. Several banks are taking this route, including CaixaBank, which has launched imaginBank, an exclusively mobile bank in Spain, and KB Kookmin Bank, which has joined Kakao, the largest mobile chat application in Korea, in a consortium to launch an online bank. This "engine 2.0" approach makes sense when a significant portion of current revenues derive from old models or when a relatively rigid organization would make it difficult to undertake a fast-paced digital transformation due to the bank’s culture or to cannibalization.

Digital scale insurgent. This is the most ambitious model and involves transforming the bank into an agile, innovative company, thereby building an advantage in customer experience, cost leadership or product innovation. While this model could create the most value if executed well, it is not a realistic option for some banks. It requires sufficient capital to invest in technology, new capabilities and new talent. Less obviously, winning with this model requires an insurgency mindset—top management’s commitment and persistence to transform, with the understanding that the journey could be long and painful, and economic returns will take time to materialize. The organization should have the ability to leverage hidden assets and to partner with technology firms, testing and learning as it goes. Commonwealth Bank of Australia has started down this path.

Manage for cash. Banks that do not have a strong enough starting position to pursue any of the options above may choose to keep operating the bank’s current model without significant capital expenditures. This may be the most realistic option for many regional banks struggling in an economically stressed market, such as Spain. Manage for cash could become an attractive equity play if the bank maintains a credible track record so that it can be acquired at a favorable multiple. A favorable outcome will depend on there being good exit opportunities, including enough willing buyers, at the chosen time.

Gauging the point of departure

How should bank boards and executives think about choosing which strategic option to pursue? Three factors will come into play here.

First, the degree of strategic freedom for an individual bank will depend on its core country markets and how the scenarios unfold in each.

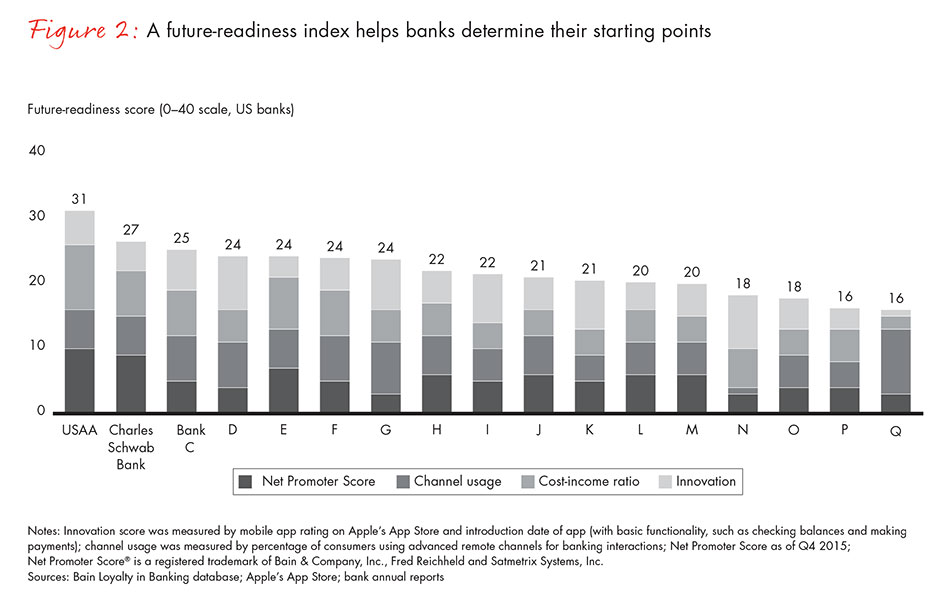

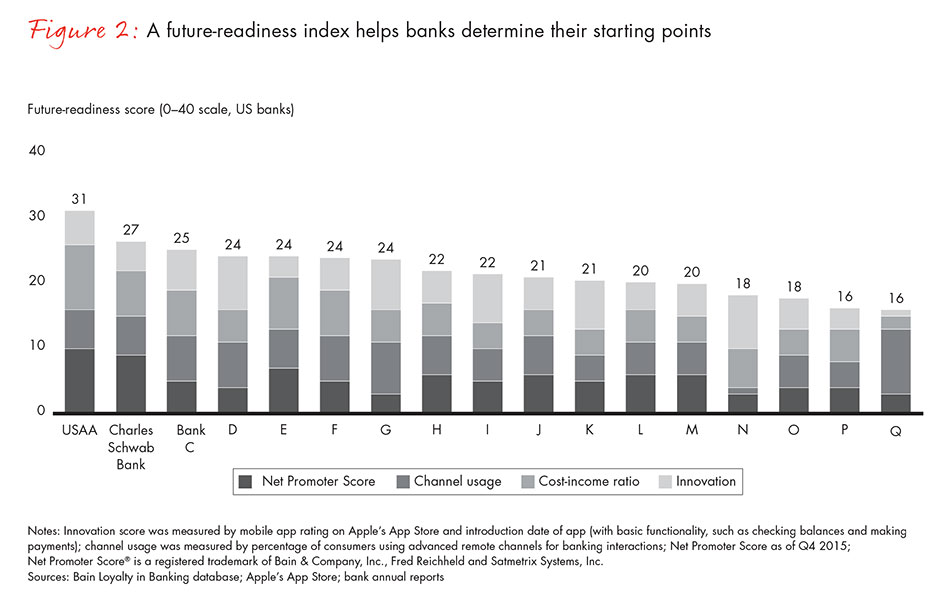

Second, a bank’s options will be determined by its readiness to adapt. We have assembled a composite index to assess future readiness across four variables: innovation, digital channel usage, cost-income ratio and customer advocacy (see Figure 2).

Each of these variables can inform the point of departure and possible options. A bank aspiring to be a relationship master, for example, would need to be No. 1 or No. 2 in customer advocacy in its market, whereas No. 5 has little hope of winning along that dimension. The future readiness index for the US shows that USAA and Charles Schwab Bank are relatively well prepared to pursue several strategic options. Banks with low readiness scores, by contrast, will have fewer degrees of strategic freedom.

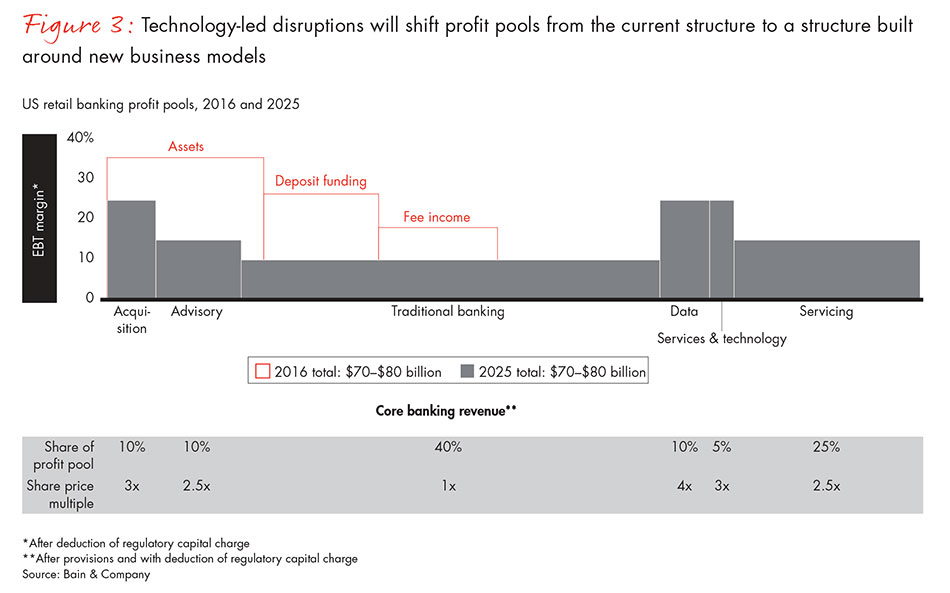

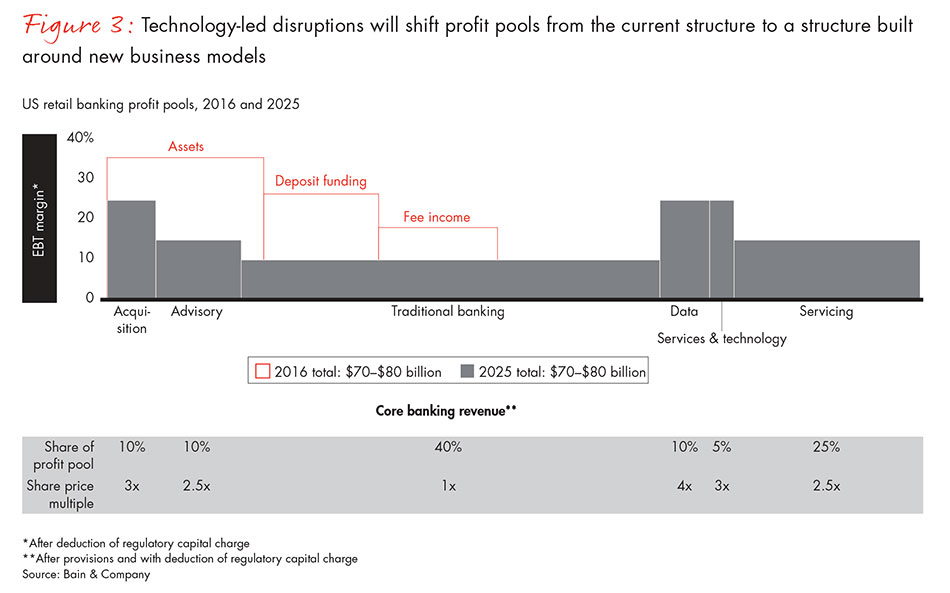

The third factor concerns how retail banking profit pools will shift in response to the trends described earlier. As banks move to the business models described above, it becomes increasingly important to update their views on future profit pools. The standard view of profit pools, by type of banking product or P&L impact, will shift to a view that better depicts specific elements of the value chain, where new entrants are seeking to innovate (see Figure 3):

Acquisition. This profit pool reflects front-end sales and origination income, such as income from mortgage or other lending, or insurance brokerage. The profit pool might split between a bank and an alternative provider, such as an online lender or marketplace, with relatively high margins.

Advisory. This earnings stream is derived from banks serving more complex financial needs, such as investments or private banking. Fintechs have focused on the investment area, and we expect them to emerge in everyday banking advice and money management in the future.

Traditional banking. Profit stems from balance-sheet deployment of credit and transfer pricing from low-cost deposit funding. These could be handled as white-label activities by bank "utilities," albeit in the face of continued margin and cost pressures.

Data. Data from customer transactions and interactions has implicit value. For example, banks could leverage customer data in order to make better underwriting or marketing decisions. Profits derive not from the sale of that data, but from mining data or creating new data sources from operational activities such as servicing.

Technology platforms. These are profits generated when banks share access to their products and solutions through their proprietary technology platforms or APIs with other companies, as The Bancorp does in the US.

Servicing. These profits come from services offered to customers, such as mortgage servicing or per-item transaction fees, which have attractive margins. Expect banks and alternative providers to expand the set of value-added activities for their consumer and business banking customers, such as escrow and tax services and cross-border transactions.

We expect the total profit pool for retail banking to hold roughly steady by 2025, although banks will face more competition from technology firms and the composition of the pool will look very different. The good news: New profit pools such as data and services and technology will yield higher margins than the traditional banking book. They also will secure higher multiples from investors, mainly because these activities require less capital than credit and less operational intensity than deposits.

The scenarios, readiness index and profit-pool forecast give banks the tools to understand their starting points and future options. To set about narrowing their choices, board members and executives of banks can address a set of pointed questions: What is our ambition for the bank? What key tactics and capabilities will help us reach our full potential? How will we choreograph and manage the transition?

As new competitors make inroads into banks’ traditional strongholds, bankers can no longer afford to keep all their options open. In order to succeed in more fluid, digital-led financial services markets, they will have to make hard choices about what type of bank they want to become and how they will win at their chosen game.

Joe Fielding, Nicolás López and Gary Turner are partners with Bain & Company’s Financial Services practice. They are based, respectively, in New York, Madrid and Sydney. James Hadley leads Bain’s Strategy practice in Europe, the Middle East and Africa, and is based in London.