Retail Holiday Newsletter

En Bref

- Stubborn inflation will likely push nominal holiday sales within range of our forecasted 7.5% year-over-year growth, but retailers are grappling with skyrocketing input costs and cautious shoppers.

- Some retailers are increasing revenue, margins, and transactions amid inflationary pressure. These growth leaders are more selective about where they raise prices and offer promotions.

- According to Bain research, shoppers say they care more about everyday value than sales or promotions. And they’re shifting their spending to value retailers.

- Pricing is the most powerful way retailers can communicate value to consumers—especially during the promotional holiday period.

US retailers are navigating a holiday season rife with uncertainty. Headlines are full of mixed macroeconomic indicators, from waning consumer confidence and rising interest rates to low unemployment and increasing wages. GDP growth was surprisingly robust in the third quarter, despite continued fears of a recession. And though the Consumer Price Index (CPI) cooled slightly from 8.2% to 7.7% in October, high inflation persists. It could push nominal holiday sales growth into the range of our 7.5% forecast for the season, but it also threatens to constrain shoppers, meaning real sales may only grow 1% to 3%. Already, Bain-defined year-over-year nominal sales growth slowed from August highs of 7.9% to 6.8% in September, returning to early summer levels.

Amid the turbulence, retailers are getting an early start to the season, continuing a two-year trend. With excess inventory from earlier in the year, many launched sales events in October, although the jury is still out on how much they sparked holiday demand.

Higher inventory levels and tighter consumer budgets will force retailers to get creative with their promotion strategies this holiday season. Winning retailers will raise prices to keep up with skyrocketing input costs, but use promotions to clear out excess inventory. All the while, they’ll minimize margin erosion, avoid stockouts, and manage consumer expectations around future promotions.

Strategy-Making in Turbulent Times

A dynamic new model for managing strategy development and performance monitoring produces great results in uncertain times.

How retailers are weathering a snowstorm of inflation

As inflation rages, retailers are struggling to juggle the competing demands of multiple stakeholders: Consumers want low prices, employees want fair wages to keep up with the rising cost of living, and shareholders want to maintain profitability.

Despite the difficult balancing act, a clear set of growth leaders have emerged in each major category. These retailers grew revenues by double digits from the first half of 2021 to the first half of 2022, according to our analysis of data from S&P Capital IQ (see Figure 1a).

This growth isn’t simply due to higher prices—our analysis of Pyxis data reveals that in many categories, growth leaders are outperforming the category average for year-over-year transaction growth by 5 to 9 percentage points. And their customers are happier too: Bain research shows that in August, growth leaders’ Net Promoter ScoreSM—an indicator of customer advocacy, future growth, and customer lifetime value—was 5 points higher than the laggards’ score.

These retailers are also leading in profit. While inflationary pressure has generally decreased margins, growth leaders are beating their peers on both gross and operating margins (see Figures 1b and 1c). In some categories, such as clothing and accessories, growth leaders have even managed to increase gross margins, while their peers’ margins have declined.

What do these leaders do differently? Bain research shows that pricing strategies, including promotions, are retailers’ greatest means to boost profits—in fact, they can improve operating margins by nearly twice as much as cost and volume measures, in less time. In our experience, the most effective pricing and promotion strategies are selective. This holiday season, top retailers are being more deliberate about where they increase prices and are avoiding broad, blanket promotions.

Selective price increases

Grocers have been exemplars of selectively passing on cost increases. Large and small grocers alike are strategically holding back price increases on known value items (KVIs)—those frequently purchased items that have a strong effect on price perception—while increasing prices on non-KVIs at a higher rate to protect overall margins.

Our analysis of NielsenIQ data suggests that in categories where national brand strength doesn’t dominate the category (unlike salty snacks and carbonated beverages), grocery retailers minimized year-over-year price increases on KVIs to around 8% in October. In comparison, they increased prices approximately 14% for non-KVIs, slightly above the Consumer Price Index for food at home. In fact, year-over-year increases for non-KVIs were as high as 50% in categories such as noncarbonated beverages and bakery. When considering all categories, the median price increase for KVIs was still lower than non-KVIs at 12% (see Figure 2). By moderating price increases where it matters most, these grocers are aiming to maintain positive brand perceptions and build loyalty, despite record inflation.

This holiday season, leaders in other categories are taking a lesson from grocers. Some retailers are limiting price increases on everyday purchases, while selectively using promotions on excess inventory and seasonal items, including holiday products, to manage customer perception and clear out excess stock. For example, Kohl’s CFO says the retailer has been “aggressive on clearance as well as promotions” to manage excess inventory, including overstocked holiday items.

Targeted promotions

Retailers can use both base prices and promotions to create a little holiday magic for their customers as they search for the perfect gifts. But in recent months, retailers in many categories, except clothing and accessories, have increased base prices while scaling back their promotions compared with last year, according to our analysis of NielsenIQ and Ascential data (see Figure 3). These changes mean higher out-the-door prices for consumers for their holiday shopping.

Winning retailers are holding the line on out-the-door prices by avoiding the pitfall of steep blanket promotions. As with base price increases, they’re more strategic about which items they discount and how much. For example, growth leader Williams-Sonoma has unlocked value partly by eliminating site-wide discounts. Walmart has also announced plans to keep prices low and offer additional promotions on popular gifts.

How holiday shoppers are navigating sticker shock

Customers are feeling the burden of rising prices, and they’re voicing their opinions. US consumers’ positive sentiment on overall pricing and promotions dropped by an average of 11 percentage points in August and September, compared with last year, according to a Bain and NetBase Quid analysis of social media posts. In a low-margin category like grocery, where inflation has fueled steady price increases, positive sentiment tumbled by 17 percentage points year over year.

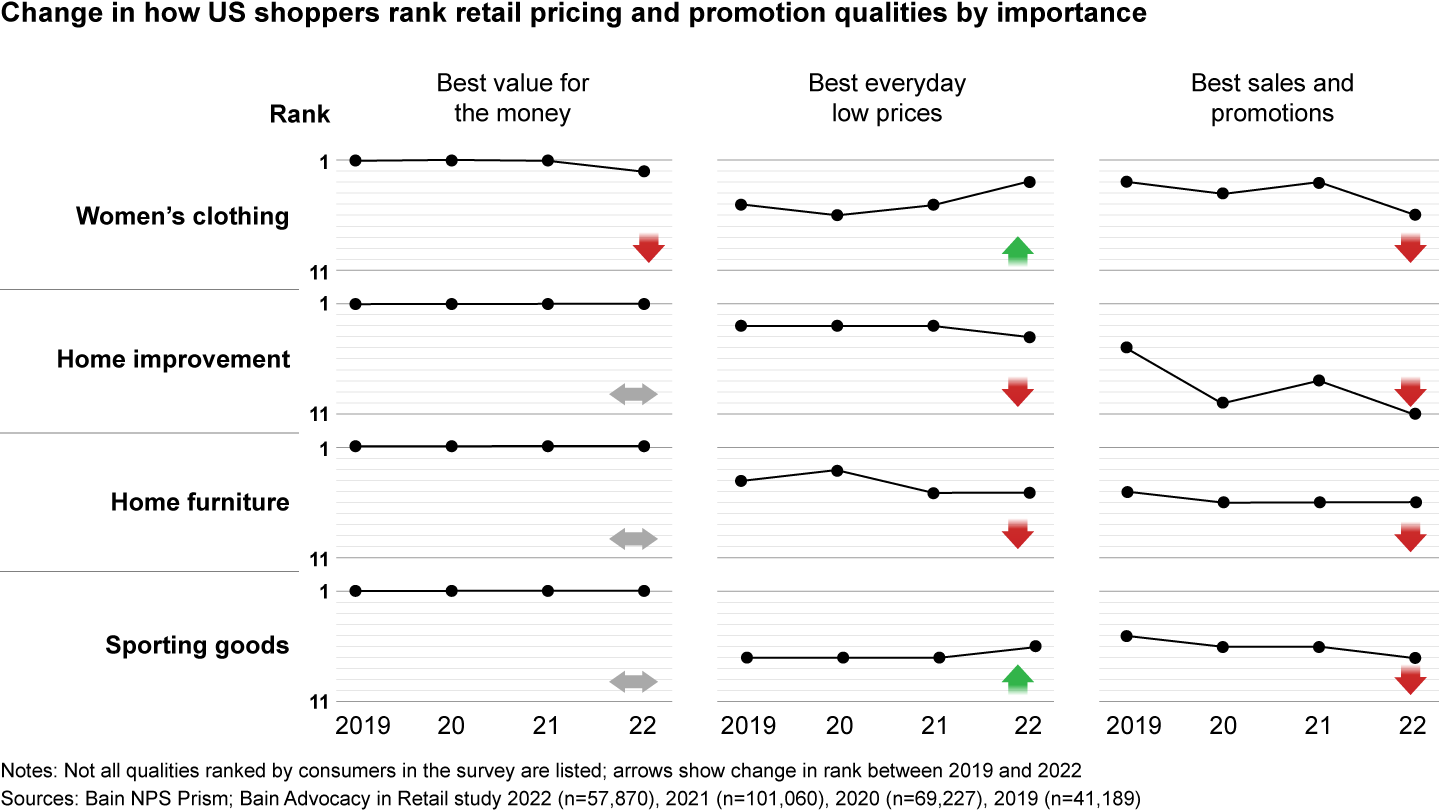

However, retailers can still delight consumers this holiday. In research conducted in partnership with ROI Rocket, we found that sales and promotions aren’t necessarily consumers’ top criteria when considering where to shop. In fact, a vast majority of shoppers say it’s most important that retailers deliver the best value for their money—and increasingly, they want that value in the form of everyday low prices (see Figures 4a and 4b).

Already, shoppers are voting with their wallets in search of greater value, moving away from upmarket retailers. Bain analysis of S&P Capital IQ data reveals that premium retailers enjoyed record-breaking 44% year-over-year growth in 2021, thanks to higher disposable income. However, consumers are now trading down, partly because of incessant inflation. Premium and midtier retailers’ year-over-year revenue growth has dropped sharply to less than 3%, compared with value retailers’ 8.5% growth (see Figure 5).

Tracking the spending of 17,000 premium shoppers from 2021 to 2022 with Pyxis, we found that share of wallet (SOW) is also slowly shifting from premium to value retailers. For instance, over the past year, premium furniture and home goods retailers lost between 1 and 3 percentage points in SOW, while their value counterparts gained around 1 to 2 percentage points. Similarly, NielsenIQ analysis reveals that value grocers increased SOW by about 1 percentage point from the first quarter to the third quarter of 2022.

Private label brands have also been gaining favor over the past five years. In the past year alone, Amazon, Walmart, and Target’s private label brands increased share in apparel by 2 percentage points and home and kitchen by 5 percentage points, according to our analysis of Pyxis transaction data. Moreover, sales for private label brands in grocery increased by around 1 percentage point between the third quarters of 2021 and 2022, based on analysis conducted by NielsenIQ.

This trend, amplified by inflation, is encouraging retailers to bolster their private label offerings. For instance, Designer Brands plans to build up its private label brands to propel sales over the next five years. Similarly, Target’s CEO noted the retailer is expecting to continue the booming growth of its $30 billion business of 48 private labels over the holiday season.

For premium retailers, these changes in consumer behavior are an opportunity to redefine value, especially during the holiday season. Some growth leaders, such as Nordstrom, are relying on “modest luxury” product ranges and services or including more value options in their assortments. For the holidays, Nordstrom is aiming to make its off-price store, Nordstrom Rack, a destination for value gifting, with more deals on premium gifts, complimentary gift boxes, and curated “gift shops” for different budgets.

To stand out amid price pressure, premium retailers are also creating differentiated experiences, both pre- and post-purchase. Pottery Barn is offering a “holiday concierge service” to help customers through their shopping journey and beyond, from “style expert” recommendations, gift wrapping, and installation services, to party planning and home decorating.

Getting pricing right for the holidays

With Black Friday, Cyber Monday, and peak shopping weeks around the corner, holiday promotions represent an undeniable opportunity for retailers to convey value to inflation-weary consumers. Nearly two-thirds of shoppers say they plan to spend significantly more time looking for discounts this holiday season, according to a recent ICSC survey. To stand out amid the glut of promotional messages, retailers can take four actions.

1. Delight early shoppers with deep discounts on overstocked items.

As inventory piles up, winning retailers will plan effective promotions to avoid fire sales at the end of the holiday season. In our experience, clearing excess merchandise early at a fair discount delivers better results and more satisfied customers. The standard playbook of starting with shallower discounts and incrementally increasing them over time can frustrate shoppers, who are unsure whether to buy immediately or wait for a better deal. And if they guess wrong, they’re likely to request price matches.

Instead, leaders will discount early and deep to give customers an offer they can’t refuse—and make them feel heard as they increasingly seek value. These retailers will also have a clear understanding of how effective their promotions are. In particular, they will forecast how much inventory they can clear at a given level of discount.

2. Entice customers with holiday-centric promotions and cross-merchandise.

Winning retailers will not only focus promotions on items that get consumers in the door, but also encourage them to add to their basket through smart merchandising decisions. These radiated sales include immediate adjacencies—like the typical strategy of high-margin spices beside turkeys or jewelry next to dresses—as well as creatively positioned one-step adjacencies—like food packaging for leftovers beside turkeys and spices or complementary basics next to trendy clothing.

A delightful shopping experience can extend the halo of purchases to items that weren’t originally on shoppers’ lists. Happy holiday shoppers typically become brand loyalists, and successful shopping trips will give customers even more reasons to return.

3. Generate loyalty through personalized promotions and a differentiated experience.

Given the amount of share up for grabs at this time of year, winning retailers will resist the urge to simply shave dollars off the entire catalog. Providing tailored deals to the highest-value customers will be key to spurring loyalty and retaining share when blanket discounts are everywhere.

At the same time, promotions alone won’t be enough. As Seth Godin, a best-selling author and marketing guru, wrote, “Perhaps the reason price is all your customers care about is because you haven’t given them anything else to care about.” In a world of limited resources, leading retailers will invest sufficient time and money in other aspects of their customer value proposition, such as high in-stock rates and convenient shopping experiences, to turn a happy holiday into long-term loyalty.

4. Rely more on empirical data than intuition.

Today’s unique economic environment renders recent experiences less meaningful. Now more than ever, retailers need to make pricing and promotion decisions based on real-time data. Seasonal winners will use detailed forecasts to inform promotions, articulating their effect not just on the top and bottom lines, but also on inventory management, delivery lead times, and other aspects of the customer experience.

Beyond forecasts, the ability to test and pivot swiftly will separate holiday leaders from laggards. These retailers will clearly define scenarios, establish a streamlined decision-making process that cascades through the organization, and harness data and technology to pivot quickly and at scale.

Planning for pricing and promotions beyond the season

The eventual return to less inflationary times will be an opportunity to craft a differentiated pricing and promotion strategy that avoids falling back into prepandemic discounting cycles. While this journey differs for each retailer, it’s typically anchored by four main pillars.

1. Understand pricing’s role in the brand value proposition.

Winning retailers don’t necessarily deliver a best-in-class experience on every dimension. But they’re clear about where they want to stand out—be it quality, price, service, or convenience. The relative importance of pricing to a retailer’s consumer value proposition isn’t static. Retailers that keep a finger on the metaphorical pulse of customer needs tend to create standout experiences.

2. Reflect on current pricing capabilities.

Winning retailers know when they should empower employees to make incisive, data-driven pricing decisions that are responsive to market dynamics. Post-holiday season is a good time for retailers to reflect on their pricing capabilities and identify key areas of vulnerability. Industry leaders are deliberate about what it truly takes to support their pricing capabilities, often asking four questions:

- Data and analytics. Do we have the right technology, tools, and data structures to correctly inform dynamic pricing actions at scale?

- Monitoring and measurement. Can we rapidly assess the efficacy of our promotional efforts to inform our pricing strategy and tactics?

- Operating model and talent. Do we have the right skills, talent, and organizational structures to support dynamic pricing decisions?

- Governance. Do we have the right decision-making processes and clear accountabilities to price dynamically and capture value?

Pricing Capability X-Ray

Nothing boosts profits like smarter pricing. Get started with a fast, flexible assessment that quickly reveals your strengths and weaknesses.

3. Gain an edge using technology, data, and analytics.

The ability to adapt prices and promotions quickly and at scale to create a truly differentiated value proposition often separates the best from the rest. Winning retailers measure the outcomes of pricing strategy in real time, using technology such as dynamic pricing software with scenario analysis capabilities. They maximize efficiency with tools like electronic price tags. And they employ data analytics to pivot, adapt, or double down on their approach based on the value at stake.

Pricing and Promotions

Our Promotions Accelerator helps drive profitability by combining data-driven analysis and strategy to deliver lasting impact.

4. Resist the urge to revert to the status quo.

Before the pandemic, many retail sectors suffered from the discount disease, resulting in sustained margin erosion. Ratcheting back prices and reverting to high-low pricing games at the first sign of abating inflation may be a tempting competitive play in the short term. But retailers will have an unparalleled opportunity to manage pricing and promotions more strategically moving forward.

Not all categories are created equal. A reset of base prices, paired with the reintroduction of promotions in the right categories at the right breadth and depth, can be the key to unlocking sustained profitable growth as inflation eases.

About our research partners

Ascential is a global specialist information company that partners with businesses to win in the digital economy. Edge by Ascential provides customers with comprehensive and actionable e-commerce-driven data, such as real-time digital shelf performance metrics, monitoring of price movements and product listings, and SKU- and category-level online sales and share. For more information about Ascential, visit ascential.com.

NetBase Quid delivers AI-powered consumer and market intelligence to enable business reinvention in a noisy and unpredictable world. Its platform uses advanced artificial intelligence to process billions of indexed resources across all forms of structured and unstructured data, empowering brand, agency, and consulting services customers to make smart, data-driven decisions accurately, quickly, and efficiently. Learn more at netbasequid.com.

NielsenIQ is a global information services company that delivers a connected, complete, and actionable understanding of the evolving global, omnichannel consumer. NielsenIQ's data, connected insights, and predictive analytics optimize the performance of consumer packaged goods (CPG) and retail companies around the world. NielsenIQ operates in more than 90 markets, covering more than 90% of the world's population. For more information, visit nielseniq.com.

ROI Rocket is a leading provider of full-service research, fulfillment, and digital and direct marketing support to a broad client base of consultants, investors, publicly and privately held corporations, agencies, and market research firms. ROI is a Bain customer advocacy benchmark partner in grocery and 10 other retail categories. For details, visit www.roirocket.com or contact Noah Seton (noah.seton@roirocket.com).

The S&P Capital IQ platform, an offering of S&P Global Market Intelligence, is a single source for a powerful array of financial data, analytics, and research. The web-based platform combines deep information on companies, markets, and people worldwide with robust tools for analysis, idea generation, and workflow management. Learn more at spglobal.com.

NPS Prism®

A CX benchmarking platform to grow loyalty and sales. Get unbiased NPS scores for you and your competitors.

Pyxis is a powerful data analysis platform that reveals where, how and why consumers buy, how they pay, how much they spend, how their needs and demands are changing, and much more.

The authors would like to acknowledge Anirudha Sharma, Adam Kowalski, Quinn Creamer, Daniella Valverde, and Darsh Jalan for their contributions to this newsletter.

Net Promoter Score℠ is a service mark of Bain & Company, Inc., Satmetrix Systems, Inc., and Fred Reichheld.