M&A Report

Auf einen Blick

- The year 2020 saw a 15% decline in consumer products deals, with category and channel disruption leading many companies to revisit their strategies. As they do, we expect a rebound in M&A activity fueled by smaller capability and growth deals as well as divestitures.

- Despite some historic questions around the success of smaller rollup plays, our survey suggests that these deals can be successful. Identifying and integrating these smaller deals without destroying value or their unique magic is challenging, but a new winning playbook is emerging.

- Divestitures will continue to be a critical part of a balanced M&A strategy. Sellers should seize the opportunity to rebalance their portfolios in response to category and channel disruption. Buyers can bring new parenting advantages to revitalize brands. Both can learn from historic successes and failures.

- Experience suggests that those companies that seize these opportunities will emerge from the crisis and subsequent shakeout as winners. Speed and conviction will be critical.

The state of consumer products M&A—the challenges and opportunities it brings

In consumer products, the year 2020 saw deal value drop by 15%, similar to the broader market decline.

It would be natural to blame the Covid-19 pandemic for these results, but digging deeper, we see that they represent a continuation of trends that have been playing out over the past three to five years. For example, global deal value for transactions greater than $500 million has dropped since 2015, the year in which megadeals peaked (see Figure 1).

The most profound change in consumer products M&A is in deal mix. Scope and capability deals now make up 60% of deals greater than $1 billion despite multiples that are about 30% higher and cost synergies that are roughly 45% lower than they are in scale deals. Deal activity for insurgent brands—that is, those brands that significantly outpace category growth while simultaneously reaching minimum scale—has grown twofold to threefold since 2015.

These trends point to a more fundamental change in M&A strategy as the consumer products industry reacts to low growth and historic disruption in consumer needs, channel shifts, and competition. Revisiting strategic priorities is reflected in the findings from our M&A practitioners’ survey: 76% of respondents in consumer products say that their companies have updated their strategies in 2020.

Building the required portfolio of brands and capabilities organically can be time consuming and risky. The inorganic route, while still uncertain, offers the opportunity to act decisively. That view was reflected in the fact that 45% of surveyed consumer products M&A practitioners expect deals to increase over the next 12 months; only 10% expect them to decrease.

M&A creates challenges and opportunities.

First, the good news. Despite recent turbulence, the golden rules of M&A still hold. Frequent and material acquirers outperform those that acquire less frequently, with an average total shareholder return of 10.9% vs. 7.6%. This is because they build the end-to-end, repeatable capability for effective screening, diligence, and executing transactions and integrations.

Executing a smaller scope deal, however, is drastically different from a scale play. Executives in our survey rightly worry about the best way to achieve the required revenue synergies while retaining talent and scaling the acquired capabilities.

Furthermore, rebalancing the portfolio means selectively divesting to free up capital and focus. About 35% of consumer products executives responding to our survey expected divestiture activity to increase. Even if divestitures are attractive, they can be difficult to time and distracting for management. Survey respondents mentioned the challenges of dealing with functional entanglements, stranded costs, tax, and earnings implications as the biggest factors inhibiting divestitures (see Figure 2).

In the next two sections, we share what companies are learning from smaller deals and divestitures.

Winning with smaller rollup plays

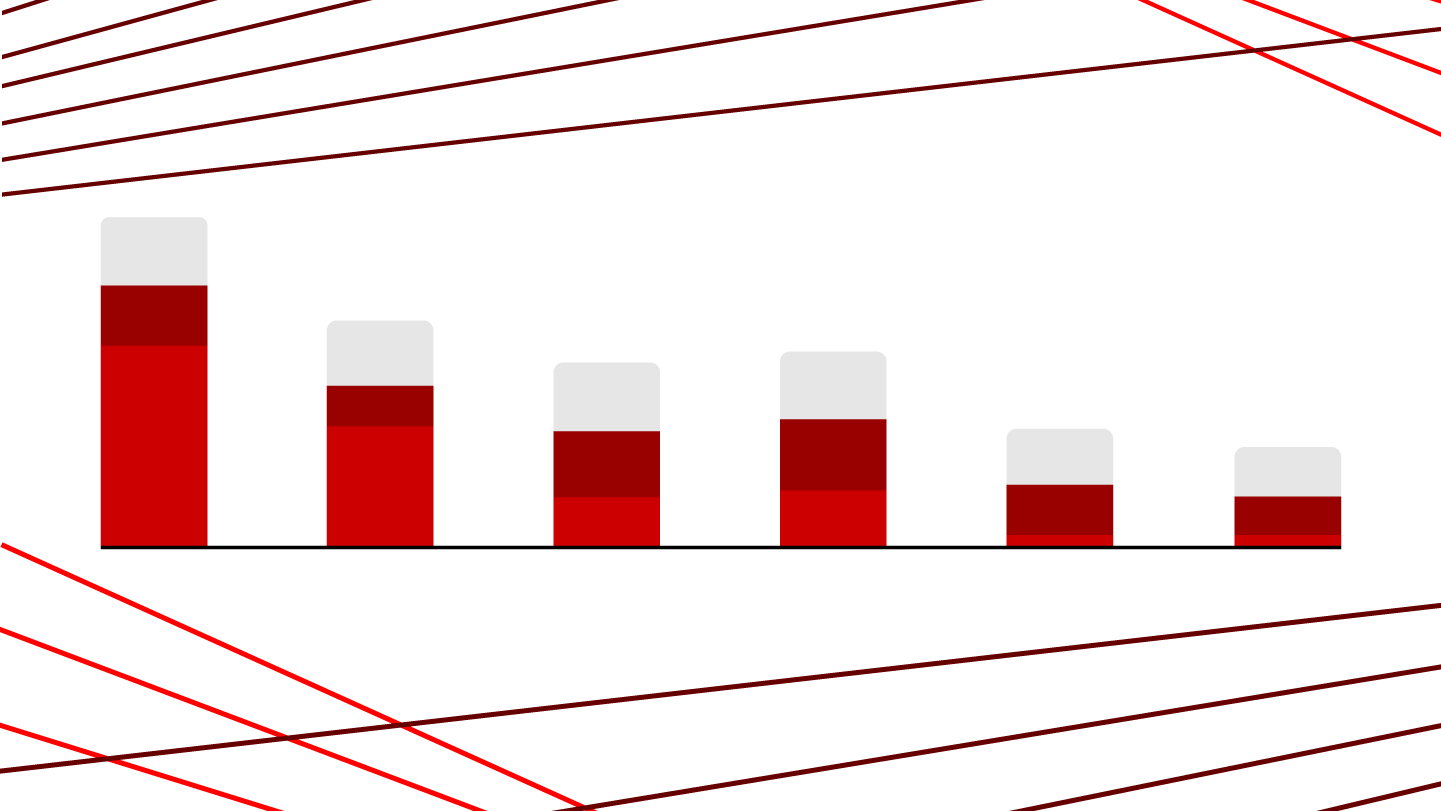

Smaller deals in consumer products are typically done for two reasons. First, to buy and build a new business (for instance, in a new category or geography). These often are called “string of pearls” deals. Among our survey respondents, 60% expect these types of deals to increase over the next 12 months. A second deal objective is buying or building new capabilities. Such deals done by the top 11 most acquisitive consumer products companies represented less than 5% of all M&A five years ago, and they have now grown to account for more than a third of all deals (see Figure 3). For example, Unilever expanded into personal care with the acquisition of Dollar Shave Club (men’s grooming) and Hourglass (cosmetics) as part of a broader strategy to shift from food into more premium segments. Nestlé built its presence in pet care by acquiring Zuke’s, Merrick, Terra Canis, and Lily’s Kitchen; it had earlier expanded into pet services with Petfinder. In beverages, AB InBev created a rollup of smaller craft and local breweries, such as Goose Island, Elysian, and Craft Brew Alliance, to compete in this high-growth, premium space.

When we looked at this topic in our 2018 M&A annual report, the jury was largely still out on both the best way to integrate these smaller deals as well as how successful this strategy would prove over the long haul. Two years later, there is consensus that these deals can be successful. More than 65% of our respondents involved in “string of pearls” deals claimed success; less than 10% said the deals were failures. We also now have a clearer understanding of what makes these deals successful. The top factors cited by M&A practitioners included having a clear deal thesis and developing the appropriate operating model to integrate and scale the business (see Figure 4).

On the flip side, however, our analysis found that insurgent brand growth rates drop by an average of 58% post-acquisition. While some decline can be expected as brands mature, we see four common reasons for failure:

- missing critical red flags in diligence (often cultural or operational elements);

- overintegrating and suffocating the target’s capabilities, undermining its culture, or driving critical talent departures;

- scaling distribution too fast and ahead of velocity, impacting long-term brand health; and

- underintegrating and missing the parenting advantages that underpinned the deal in the first place.

In line with these lessons and based on more than 50 projects in this area over the past five years, we see a new “string of pearls” playbook emerging.

The New M&A Playbook for Consumer Products

For acquirers with speed and conviction, “string of pearls” deals are proving successful.

Widen the aperture on screening opportunities. Set a clear long-term strategy based on your unique parenting advantages. Proactively implement a two-for-one approach—that is, hunt for companies that bring both a new product or brand and critical capabilities. This will give you the conviction required to pay today’s deal multiples.

Push the boundaries on world-class diligence. Even when transparency can be low, start with a clear, testable deal thesis, articulating why this deal will add value. Use the deal thesis to pressure test the base business, identify red flags, and clarify parenting advantages that only you will unlock. Lastly, think about integration early—assess organizational and cultural fit, and begin to identify Day 1 issues.

Have a tailored integration thesis that flows from the deal thesis. Be clear on what to integrate and what to leave alone. Integrate where there will be definite functional synergies, such as compliance or back office. Selectively integrate where required to deliver the value in the deal thesis, and separate areas that risk otherwise destroying the culture (for example, human resources, incentives, headquarters).

Protect the Founder’s Mentality® magic. Most insurgents’ success is rooted in the founder’s conviction to meet a real need that the brand is uniquely placed to address. This Founder’s Mentality permeates throughout the organization and creates a passionate and empowered front line with an aversion to bureaucracy. Sustaining that insurgent mindset is critical. Acquirers must actively secure key talent (most often, including the founder) early. Furthermore, allow the acquired business to opt in to services or capabilities in which they see value (supply chain and sales, for example) rather than imposing integration top down. “Chief interference officers” can help to reduce unwanted distractions and limit requests to the most critical.

Set appropriate margin expectations. Margins will not always be accretive, depending on the category and business model. Pushing for cost synergies can starve the business, lead to critical talent departures, and severely affect morale. Define long-term expectations and the path to get there, and be patient.

Balance your scaling ambition. For many of these deals, a larger consumer products company’s ability to more rapidly scale the asset is a cornerstone of the value creation plan. For smaller insurgent brands, however, being measured and thoughtful about where and when to expand distribution is critical to achieving sustained growth. Maintaining distribution for these smaller brands can be as difficult as attaining it. Therefore, ensure that post-acquisition efforts balance brand health and other velocity-driving actions alongside the pushes for increased distribution.

While the first 100 days are important, they are not the end state. The most successful teams think through and plan for evolution in two areas. First, defining areas in which to transfer capabilities back to the parent. Second, using the acquisition as a stepping-stone to build out a bigger, wider platform—for example, continuing to grow the string of pearls.

We have seen similar trends for capability deals, with deal volume increasing multiple times since 2015. Competition for these assets is only likely to increase, especially for capabilities spotlighted in response to the Covid-19 crisis, such as consumer and shopper insights and data, digital marketing, business-to-business sales, e-commerce, and supply chain agility. The playbook for these deals is similar, with additional nuance. For example, due diligence becomes even more critical—the acquirer will often have less visibility and knowledge of the target business model, market dynamics, and talent, requiring increased scrutiny and conviction in the parent company value add.

Remember, identifying and integrating these smaller deals without destroying the value is more challenging than many historic scale deals, even for serial acquirers. You will need to retool and retrain your teams and boost your M&A ecosystem to get this right.

Divestitures to benefit buyers and sellers

Over the past two years, carve-outs have represented around 43% of large deal value, fueled by significant appetite from strategic and financial buyers alike. Just in 2019, we saw AB InBev selling its Australian business to Asahi, Nestlé’s announced deal to sell its US ice cream business to Froneri, and Campbell’s selling Arnott’s to KKR. In 2020, deals continued to be struck—for example, Kraft-Heinz selling its natural cheese business to Groupe Lactalis in September.

Ready, Set, Divest: The Portfolio Imperative in Consumer Products

Sellers and buyers that quickly seize opportunities can emerge from the crisis as winners.

As we mentioned above, 2021 is unlikely to be different. Covid-19 has created an urgency for sellers to carve out noncore businesses for immediate liquidity, to refocus management bandwidth, or to redeploy capital to faster-growing areas. Meanwhile, with few structural capital constraints, buy-side demand is strong, both from corporates and from private equity firms sitting on record levels of dry powder. With today’s environment and management teams already running at full tilt, it may sound appealing to wait, but that will often prove wrong.

From the seller perspective, we have always maintained that divestitures create highest value when they are done proactively and regularly. Most consumer products companies acknowledge this, but too many still hold on to noncore businesses for too long, attempting to optimize timing or valuation. Value only erodes further, however, as business performance suffers from lack of resources and focus. Meanwhile, buyers are looking to bring new parenting advantages to revitalize brands that have stalled or that are undermanaged under current ownership.

For both sellers and buyers, executing a carve-out is never straightforward and typically more complex than most other forms of M&A. From years of experience, we observe five best practices that can separate the successes from the failures.

Sellers should look to build conviction and take a buyer lens to act decisively.

Build conviction to act. Proactively address your portfolio by reevaluating each business for strategic and parenting value add in the post–Covid-19 world. Commit to a proactive phased plan—once a business has been identified for divestment, it is often best to move quickly. Then prepare to enable a successful transaction by engaging the best prospective parents and setting realistic expectations for the negotiation, valuation, and walkaway price.

Think like a buyer. With significant uncertainty, it is critical to identify what will be most attractive for the buyer. Develop a clear equity story and an investment thesis that addresses multiple scenarios. Execute reverse due diligence. Anticipate buyer transition service agreement (TSA) needs, and set up the separation program to orchestrate the process.

Buyers hunting for deals in the current disrupted environment are flexing standard processes to minimize risk.

Differentiate on screening and diligence. Competitors are widening the aperture on screening, using a broader range of data sources, ecosystem partners, and artificial intelligence to update their chessboards and priorities. Given remote ways of working, some are prioritizing assets that can be analyzed at a distance, have less entanglement, and lower uncertainty. They’re also acknowledging the deal premium these assets demand. Diligence then pushes beyond standalone commercial and operational issues to get to a deep understanding of the risks created by talent, culture, operational linkages, and resulting TSAs.

Get creative on deal structures. Given future uncertainty and high asset prices, it can be difficult to get the right bid. To make the deal work, find ways to share the risk and upside with the seller. Consider earn-outs, waterfalls, use of equity, and other results-driven incentives to ensure seller commitment to the future business.

For both sellers and buyers, striking the right deal is only the first step; execution must be robustly planned and managed.

Be smart about important process and technology decisions. These decisions typically carry the biggest dis-synergies, the highest one-time costs, and impact the bulk of the TSAs. In our experience, they are also the least understood. The right approach and resulting dis-synergies can vary widely, driven by the complexity of the situation.

Faced with this uncertainty, a robust fact base and option assessment are required. Cloning systems is one option. It can be lower risk, less costly, and faster, but it is never as simple as it might at first appear and can reduce the long-term value for the new company. Alternatively, taking a greenfield approach can bring more long-term value, but it often requires one to two years of stabilization. In the end, the most common approach is a hybrid, with the majority of systems standardized and cloned but a few differentiated elements dealt with separately.

Technology separation should also serve as an unlocking moment. In our experience, companies that invest in their long-term growth agenda during technology separation (for instance, evolving their infrastructure to the cloud) typically generate more growth post–carve-out.

Divestitures are likely to remain a large part of the deal mix, and they offer a powerful tool to realign portfolios and revitalize brands. While some companies have already started to develop the muscles to pull this off—for example, Nestlé, Unilever, AB InBev, and Procter & Gamble have all executed more than 30 divestments over the past 10 years—for many, this will be a newer journey, requiring new capabilities, muscles, and playbooks.

In summary, Covid-19 significantly disrupted consumer products industry dealmaking in 2020, but the challenge to find growth and realign portfolios is as strong as ever. We expect a rebound throughout 2021 as consumer products companies continue to shift their deal mix to smaller brands, coveted capabilities, and divestitures. Experience suggests those that seize these opportunities will emerge from the subsequent shakeout as the next winners, and those that miss out may struggle.

For many companies, pulling off new types of deals is not easy, which is only exacerbated during a pandemic. Having said that, we can all learn from the winners of the past.

- Rebase your M&A strategy for the new reality. Understand the impact of the latest market, category, and channel disruptions and trends.

- Don’t get caught holding on to noncore assets too long. Systematically manage your portfolio through an effective, consistent rhythm of integration and divestiture.

- Invest in better, faster due diligence that not only identifies red flags but also rapidly creates a proprietary view on full potential and highlights integration challenges.

- Update your integration playbooks to deliver bespoke integration approaches. Even if you have them today, revisit chapters for the latest deal types, digital tools, and learnings. Double down on your process and systems capabilities.

- Build differentiated capabilities, ecosystems, and tools. To win, your teams need to move faster and with more conviction, enabled by better data and the right support.

Founder’s Mentality® is a registered trademark of Bain & Company, Inc.